Loan Officers can be sponsored by Loan Factory in 48 states (except Connecticut and New York)

LICENSED IN MULTIPLE STATES AND SPONSORED BY DIFFERENT MORTGAGE COMPANIES

DID YOU KNOW?

Loan Officers (even brokers) can be licensed in multiple states and be sponsored by different mortgage companies.

- General Rule: In each state, a Loan Officer can be sponsored by only one mortgage company.

- Exceptions: In CO, DE, ME, MN, TX, and WA, a Loan Officer can have multiple sponsors.

-

Special States:

In GA, MT, OH, OR and PA, a Loan Officer can be sponsored by Loan Factory. The Loan Officer cannot be sponsored (in any 50 states) by any other mortgage company who has a license in these states.

In SC, a Loan Officer cannot be sponsored (in any 50 states) by any other mortgage company in any other state.

In VA, if a Loan Officer wants to get paid in 1099, LO must sign an Exclusive Agent Agreement with Loan Factory. The LO cannot work with any other mortgage company, in any state.

ADDING NEW STATE LICENSES

If you are CURRENTLY licensed and want to obtain license in more states, you DO NOT need to pass the exam again

Step 1

Pick an interested state

Select the state you want to obtain a license. You will see the number of hours of a state-specific

course that you must take in order to obtain a license. In general, you do not need to pass the exam

again

The following states do not require additional hours (You can skip to step 3 below):

Alabama

Delaware

Iowa

Louisiana

Missouri

Virginia

Alaska

Georgia (W-2)

Kansas

Maine

North Dakota

Wisconsin

Arkansas

Illinois

Kentucky

Minnesota

South Dakota

Wyoming

Step 2

Register and complete the state-specific course at www.mortgage-education.com

Make sure to click on this button (see below) and select the state. Each hour will cost $15. Therefore,

if you need to take a 3-hour course, it will cost you $45

Step 3

Apply for the state license on NMLS

Login to NMLS and complete the individual form (MU4), pay

any associated fees, and submit application to NMLS

Step 4

Request sponsorship

See below for the steps to request NMLS Sponsorship from Loan

Factory

REQUEST NMLS SPONSORSHIP FROM LOAN FACTORY

These are steps to sign up with Loan Factory

Step 1

Log in to NMLS and Grant Access Right to Loan Factory.

Step 2

Remove your relationship with your current employer, put an end date to your prior employment and submit a new MU4 to add Loan Factory as your employer.

Step 3

Request NMLS Sponsorship from Loan Factory (NMLS #: 320841). Loan Factory will be notified and proceed to sponsor you.

Step 4

Resolve any Active License Items that the state will ask you. (You must log in and check NMLS regularly and clear the requests from the state. Once complete, it will take the regulator around 5-7 days to approve.)

HOW LONG WOULD IT TAKE FOR LOAN FACTORY TO SPONSOR MY LICENSE?

- Alaska: 14 calendar days

- Alabama: 18 calendar days

- Arkansas: 13 calendar days

- Arizona: 20 calendar days

- California: 30 calendar days

- Colorado: 10 calendar days

- Connecticut: 3 calendar days

- District of Columbia: 38 calendar days

- Florida: 11 calendar days

- Georgia: 17 calendar days

- Hawaii: 40 calendar days

- Iowa: 15 calendar days

- Idaho: 20 calendar days

- Illinois: 9 calendar days

- Indiana: 13 calendar days

- Kansas: 33 calendar days

- Kentucky: 40 calendar days

- Louisiana: 26 calendar days

- Massachusetts: 9 calendar days

- Maryland: 24 calendar days

- Michigan: 31 calendar days

- Minnesota: 16 calendar days

- Missouri: 20 calendar days

- North Carolina: 12 calendar days

- Nebraska: 4 calendar days

- New Hampshire: 14 calendar days

- New Jersey: 24 calendar days

- New Mexico: 22 calendar days

- Nevada: 16 calendar days

- Ohio: 22 calendar days

- Oklahoma: 9 calendar days

- Oregon: 12 calendar days

- Pennsylvania: 11 calendar days

- South Carolina: 24 calendar days

- Tennessee: 15 calendar days

- Texas: 22 calendar days

- : 5 calendar days

- Utah: 11 calendar days

- Virginia: 11 calendar days

- Vermont: 6 calendar days

- Washington: 15 calendar days

- Wisconsin: 21 calendar days

- West Virginia: 19 calendar days

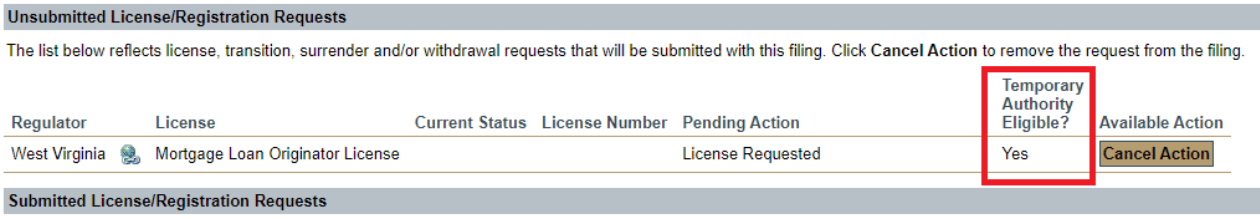

Temporary Authority Checklist

- Have you been state-licensed for 30 days or federal-registered for 1 year prior?

- Do you have a current W2 classification status showing in your NMLS record?

- Your license has not been revoked, suspended, denied, or cease and desist.

Basically, if you are currently a W-2 loan officer (with Loan Factory or with another broker/lender) with good standing, you can apply to have a license in another state. As long as you complete the license application with the NMLS, you are likely able to originate right away. You do not have to wait for the state to approve your license (normally take 3-20 business days).

SUPERVISORY DISTANCE REQUIREMENTS

There are a few states require supervisory distance between MLO's residence and current sponsoring office location (our office):

- Mississippi: 125 miles

- South Carolina: 75 miles

- Wisconsin: 100 miles

- Wyoming: 100 miles

- Nebraska: The Department does have a commutable distance requirement in place.

While there is no specific mileage figure, the Department requires that all commutable distances be

reasonable in nature.

Where a commute distance could lead to potential issues, the mortgage banker and/or MLO should be prepared

to answer any questions or

provide explanations or clarification regarding the commute to and from the associated licensed location.

- New Jersey: The Department considers a reasonable commuting distance to be 2.5 hours of the assigned

location

- Rhode Island: The remote location is the employee’s residence or other location identified in the

records of the licensee and is within

a reasonable distance of a place of business named in the licensee’s license or branch certificate, as

established by regulations adopted

by the director or the director’s designee.

COMPENSATION TYPES

-

A loan officer must be classified as either W-2 or 1099

(cannot be both).

- In these 12 states, the Loan Officer must be classified as W-2

Loan Officer: GA (Georgia), IL (Illinois), MA

(Massachusetts), MD (Maryland), MS (Mississippi), MT(Montana),

NV (Nevada), NJ (New Jersey), NC (North Carolina), SC (South

Carolina), RI (Rhode Island), and VT (Vermont).

Loan Officer: GA (Georgia), IL (Illinois), MA

(Massachusetts), MD (Maryland), MS (Mississippi), MT(Montana),

NV (Nevada), NJ (New Jersey), NC (North Carolina), SC (South

Carolina), RI (Rhode Island), and VT (Vermont).

1099 Compensation

A Loan Officer will receive 100% of the commission from every

deal they close. Loan Factory will charge a flat fee of $595 for

each deal, in addition to a processing fee of $500.

A Loan Officer will receive 90% of the commission from every deal they close, but first, they need to pay a flat fee of $595 and a processing fee of $500.

Remember, loan officers must also pay any payroll taxes themselves.